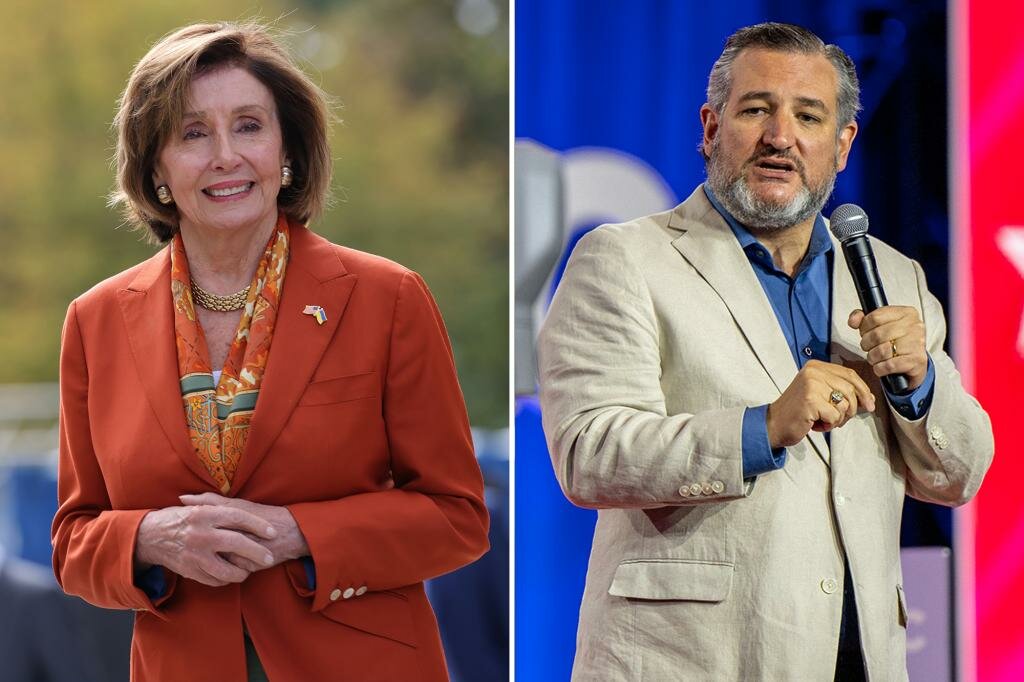

As members of Congress plan to restrict themselves from buying and selling individual shares, House Majority Leaders Nancy Pelosi (D-Calif.) and Sen. Ted Cruz (R-Texas) name two new exchange-traded funds. is the target of. Everyday investors copy their trades.

The Pelosi-themed ETF will trade under the ticker NANC in honor of the congresswoman whose husband Frequently buys and sells shares of companies regulated by his wife,

According to a September SEC filing, the NANC ETF aims to “achieve long-term capital appreciation” by mimicking the trades of Democrats in Congress.

Meanwhile, the Republican ETF will trade under the KRUZ ticker in honor of Ted Cruz, who has traded a few individual stocks while in office — but far less frequently than Pelosi.

Similarly to NANC, KRUZ seeks to achieve long-term investor returns by copying Republican trades. New York City-based Subversive Capital will be an advisor to both ETFs, which still need to secure SEC approval.

Members of Congress are required to disclose their stock trades, although they often do so weeks or months after they do.

Dozens of MLAs of both the parties have been made. Curiously timed trades include the companies they regulate, There are several members of Congress, including Cruz. Trading cryptocurrencies also reported,

Pelosi and Cruz have both said they support a ban on stock trading by members of Congress – and various proposals for a ban have been issued. been traveling since january – But it doesn’t look like a bill will go up for vote, at least before the mid-term elections.

Last Wednesday, Pelosi said she was discussing a stock trading bill, saying “we believe we have a product that we can bring to the floor this month.”

The next day, however, Democratic Sen. Jeff Merkle of Oregon told insider The vote on a stock trading ban was “not going to happen” before the November midterm election.

More than two-thirds of Americans support banning members of Congress from trading stocks, according to a January Data for Progress poll.